- Find a Brokerage Firm

- Find a Listed Company

- Contact Us

- Connect PSX

Issuance of Green Sukuk through the Pakistan Stock Exchange (PSX) marks a groundbreaking step in Pakistan's journey toward sustainable development and environmental responsibility. Structured under the Sustainable Investment (SI) Sukuk Framework, these Shariah-compliant sukuk are designed to finance priority green projects and initiatives such as renewable energy, pollution control, and climate adaptation.

By investing in Green Sukuk, you not only earn competitive returns but also contribute to greener more sustainable Pakistan! Join us in making a lasting positive impact on both the environment and society!

Benefits of Green Sukuk

Shariah Compliant

Approved by leading Shariah scholars.

Impact Driven

Funds green projects that promote renewable energy, pollution control, and climate resilience.

Attractive Returns

Offers fixed or variable rates of return with diverse tenor options (3, 5, or 10 years).

Who Should Invest?

Ethical Investors

Seeking financial growth with a positive environmental and social impact.

Institutions

Interested in expanding their sustainable finance portfolio.

Climate Advocates

Supporting Pakistan's transition to a greener, more sustainable economy.

Why Choose Green Sukuk Now?

First of its Kind

Be part of the Government of Pakistan’s first domestic Green Sukuk Issuance listed on the PSX.

Aligned with Global Standards

Contributes to achieving the United Nations Sustainable Development Goals (SDGs).

Sustainable Growth

Aligns financial goals with environmental and social responsibility.

To invest in GoP Ijarah Sukuk, access the list of BnB (Bills and Bonds) Enabled Brokers today!

Government Debt Securities (GDS) are financial instruments issued by Government of Pakistan. The duration of these instruments can generally range from as short as 3 months to a maximum of 30 years. Investors purchase these securities to essentially lend money to the government and in return government agrees to pay a periodic coupon or rentals and repay the principal at maturity. The following are a few types of GDS currently available in Pakistan:

Government of Pakistan issues both conventional as well as Islamic types of debt instruments, catering to the needs of all types of investors under the relevant rules and regulation.

.jpg)

The Federal Cabinet has approved amendments to the existing Government of Pakistan Market Treasury Bills 1998 and Government of Pakistan IJARA Sukuk Rules 2008, which aim to enhance the efficiency and flexibility of issuing, registering, trading, and transferring government debt securities (GDS). It also enables the Government to conduct Auction through Pakistan Stock Exchange (PSX) and the capital market eco system comprising of National Clearing and Settlement Company of Pakistan (NCCPL) and Central Depository Company of Pakistan (CDC), collectively known as Capital Market Infrastructure Institutions (CMIIs).

At the first phase, PSX along with other Capital Market Infrastructure Institution (CMIIs) will conduct primary market auction of following Government Debt Security in a pre-defined periodic manner:

This will be the new instrument to be auctioned through CMIIs and is not currently available at the State Bank of Pakistan's Platform.

Both the above type of instruments will now be auctioned through CMIIs

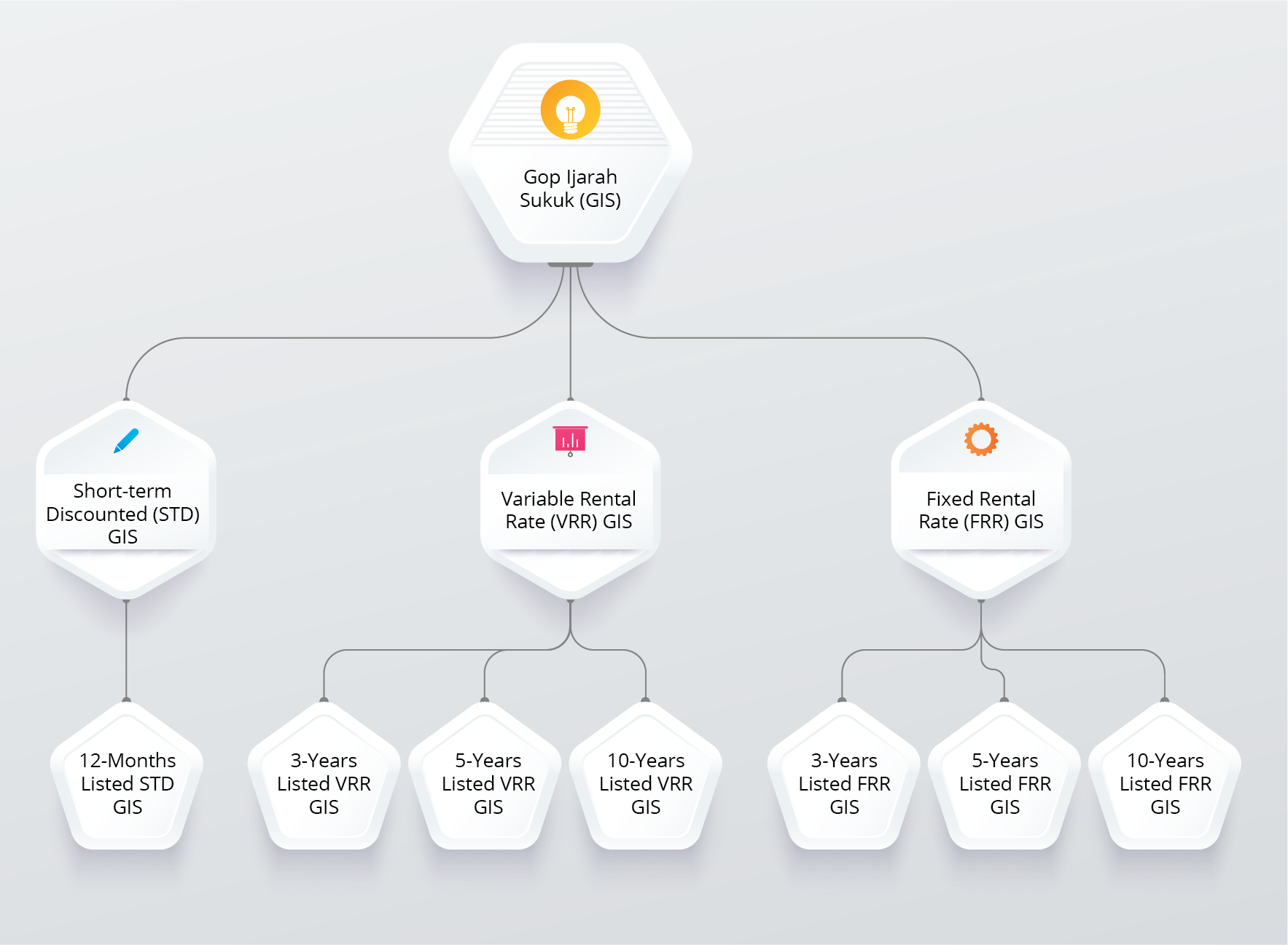

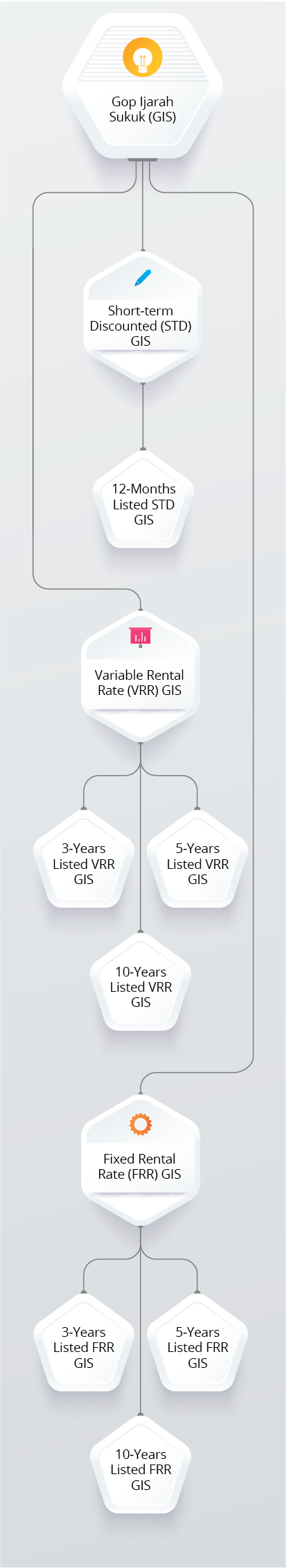

From January, 2024 onwards CMIIs will carry on the role of Primary Market Auction for all the following types of Government of Pakistan Ijarah Sukuk (GIS):

| 12 Months Fixed Rate GIS issued at Discount | |

| Auction Date | Settlement Date |

| 07-Jan-26 | 08-Jan-26 |

| 18-Feb-26 | 19-Feb-26 |

| 3-Years Fixed Rental Rate GIS | |

| Auction Date | Settlement Date |

| 07-Jan-26 | 08-Jan-26 |

| 18-Feb-26 | 19-Feb-26 |

| 5-Years Fixed Rental Rate GIS | |

| Auction Date | Settlement Date |

| 07-Jan-26 | 08-Jan-26 |

| 18-Feb-26 | 19-Feb-26 |

| 10-Years Fixed Rental Rate GIS | |

| Auction Date | Settlement Date |

| 07-Jan-26 | 08-Jan-26 |

| 18-Feb-26 | 19-Feb-26 |

| 10-Years Variable Rental Rate GIS | |

| Auction Date | Settlement Date |

| 07-Jan-26 | 08-Jan-26 |

| 18-Feb-26 | 19-Feb-26 |

For more information Click here

| Fixed Rate Discounted GIS | |

| Tenor | Cut-off rate/Price |

| 1-Year | 10.4801%/ 90.5376 |

| Fixed Rental Rate GIS | |

| Tenor | Cut-off Rental/Price |

| 3-Years | 10.7355%/ 100.0008 |

| 5-Years | 11.0300%/ 100.3661 |

| Fixed Rental Rate GIS – Zero Coupon | |

| Tenor | Cut-off rate/Price |

| 10-Years | Rejected |

| Variable Rental Rate GIS | |

| Tenor | Cut-off Margin/Rental |

| 10-Years | -32.00 bps/ 10.6800% |

For more information Click here

GoP Ijarah Sukuk(GIS) security is a type of financial instrument that involves an Islamic financing structure of Ijarah, which is a lease based arrangement compliant with Shariah principles. The structure adheres to Shariah guidelines to ensure compliance with Islamic finance principles.

The following are some of the key features of GoP Ijarah Sukuk:

Shariah compliant instruments backed by Assets

Easily tradeable through PSX trading platform in the Secondary market

GoP guarantees the payment of rental and repayment of face value at maturity

Pay higher rate of return than most bank deposits

Easy to participate in primary market auction through PSX platform

Earn attractive and regular variable or fixed profit rates

Retail Investors can participate with a nominal amount of Investment

Investors can diversify their portfolios

Acceptable as collateral as well as SLR eligible

Auction is a process in which Buyers (all eligible investors) participate in the bidding process in order to get the asset at a certain cut-off rate/price decided by the Ministry of Finance (MoF)

It is a process through which the Ministry of Finance (MoF) directly issue Government Debt Securities (GDS) through auction conducted by the Pakistan Stock Exchange (PSX) on specific auction dates pre-announced through auction calendar

The role of PSX is to conduct primary market auction through its state of the art Auction System, in which all eligible investors take part through placement of bids during the auction process

GIS are Shariah compliant Islamic instruments based on Shariah guidelines structured and approved by joint financial advisors of the Ministry of Finance.

Meezan Bank Limited, Bank Islami Pakistan Limited, Dubai Islamic Bank (Pakistan) Limited and Bank Alfalah Limited (through its Islamic window) are appointed as Joint Financial Advisors to Ministry of Finance for the Government Sukuk Program.

There will be three instruments offered:

For VRR and FRR, maturity periods of three, five, and ten years will be offered.

PSX shall notify the auction calendar along with all relevant details 5 days before the auction.

All Broker Clearing Members (BCMs) and Non-Broker Clearing Members (NBCMs) of NCCPL by themselves and on behalf of their investors are eligible to participate in the auction.

All Broker Clearing Members (BCMs) and Non-Broker Clearing Members (NBCMs) of NCCPL are allowed to submit non-competitive bids for their investors other than prop. A/c of Commercial Banks, Investment Banks, DFIs, Specialized Banks, and Microfinance Banks, and TREC Holders.”

After issuance of auction calendar notice by PSX, participants can show their expression of interest to NCCPL via email or provided URL at NCCPL website.

Participants to provide following mandatory details to NCCPL via email:

PSX will register the eligible participants in the PSX Auction System and the credentials shall be received by the contact person of eligible participants on their registered email address and mobile number.

Investor can be created by the eligible participants through following path of PSX Auction System:

Operations → Create Investor

Second step is to assign the instrument and assign cash balance to the investor by simply clicking on “Create Symbol Mapping” menu

Operations → Create Symbol Mapping

Through GDS Margin Deposit Screen provided by NCCPL on their NCSS terminals.

No. These are pre-validations checks implemented on PSX Auction System.

It is not mandatory requirement for the bid placement. For those new investors, who don’t have CDC sub account, can participate in the bidding process through Facilitation account created by CDC for this purpose. However, within 40 days the investor should open a CDC account, so that Sukuks can be credited into their respective CDC Sub Account.

A competitive bid is one wherein an investor specifies the price or yield at which he/she wishes to purchase GIS. In competitive bidding, bids are accepted in order, starting with the price higher than the minimum acceptable price or the yield.

A non-competitive bidding is an offer to purchase GIS made by the smaller investors. Non-competitive bidders do not specify the price or terms of the security. Instead, the terms are set by a competitive bidding process. Allocation happens on the single cut-off price determined by the competitive bidding

Competitive bidding rewards the highest bidder with the security, whereas non-competitive bidding allows investors to purchase securities at a price that is decided by competitive bidding, which tends to be the fair market price of the security.

An investor can participate by investing a minimum amount of PKR. 5,000 or any amount specified accordingly in GIS.

For competitive bidding, there is no maximum amount an investor can place.

For non-competitive bidding, the upper limit is 0.25% of target auction amount with no minimum value but maximum value as communicated by Ministry of Finance.

In competitive auction, an investor can place multiple bids across all participants.

In non-competitive auction, an investor can place single bid in one tenor.

This Sukuk shall be allocated to the successful bidders on single cut-off rate/price

At this stage, the pro-rata allocation methodology shall follow.

Participants and Investors shall be informed via their registered email. Secondly, participants can download successful Bidders report by logging into their Front Office terminal.

The Sukuk shall be settled as per settlement date communicated in the auction calendar.

Profit on debt will be computed for each investor of GIS based on their holding period and NCCPL will compute and deduct withholding tax on Profit on debt in accordance with the requirements prescribed under Income Tax Ordinance, 2001 at investor level either on disposal of GIS in secondary market or at Maturity.

There shall be no compulsory deduction of Zakat at source and a sahib-e-nisab may pay Zakat on his / her own according to Shariah.

No. GoP IJARA Sukuk (GIS) are script-less securities and are electronically available in a CDS Account.

The Sukuk would be redeemed by Government of Pakistan at maturity. The underlying asset of Sukuk would be purchased by the Government of Pakistan at the issue price in accordance with the purchase undertaking, while the profit component would be paid as Ijarah Rental by Government of Pakistan (GoP).

This will be the weighted average yield of 6-months T-Bill as decided in last auction or 6-months tenor rate as given on the Reuters PKRV page (121-180 days) in terms of SBP-FSCD Circular No. 13 dated September 6, 2008.

The applicable rate can be accessed at following link at the start of each period:

For Weighted Average Rates (https://www.sbp.org.pk/DFMD/pma.asp)

For PKRV Rates (https://www.mufap.com.pk/industry.php)

If the government wants to raise additional funds on the same underlying assets on which it previously raised funds (contingent to cushion left in the underlying assets), the government will have to go through the process of ‘re-opening’.

For example, the value of the underlying asset is Rs100 billion and government raised Rs60 billion in the first auction, it can still raise Rs40 billion on this underlying assets via re-opening.

The following are some of the key features related to re-opening of GIS: